How the U.S. Government Shutdown Helps China's Geopolitical Influence

With President Obama's trip to Southeast Asia cancelled, Beijing's efforts to sway opinions in the region may be more effective.

The U.S. government shutdown has claimed some more casualties. President Barack Obama’s visits to Malaysia and the Philippines next week will be called off because the logistics staff who precede the massive presidential entourage aren’t in place. Secretary of State John Kerry will go instead.

That might not be a big deal if Xi Jinping, currently in Indonesia on his first Southeast Asian tour since taking office as China’s president in March, weren’t just about to visit Malaysia too. It’s part of a charm offensive that includes a pair of giant pandas and Xiamen University’s decision to open its first overseas campus in Malaysia.

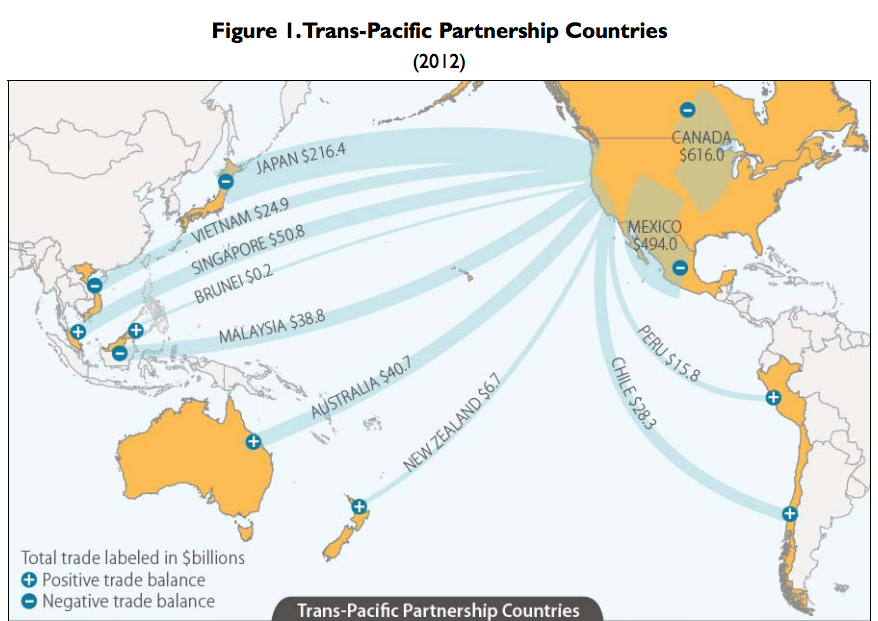

And the reason that’s a big deal is that the U.S. is trying to bring several major countries—including Malaysia—into the Trans-Pacific Partnership (TPP), a big free-trade pact linking Asia to the Americas. Besides probably being worth billions of dollars in U.S. exports and thousands of U.S. jobs, that agreement is a rival to the Asia-only free-trade agreement, the Regional Comprehensive Economic Partnership (RCEP). While the TPP is a way for the U.S. to have a bigger footprint in Asia, some see the RCEP is a potential lever for Chinese influence.

Malaysia is important to the current TPP negotiations for several reasons. First is its geopolitical significance in relation to China; along with Vietnam, Malaysia is the only negotiating Southeast Asian country slated to join.

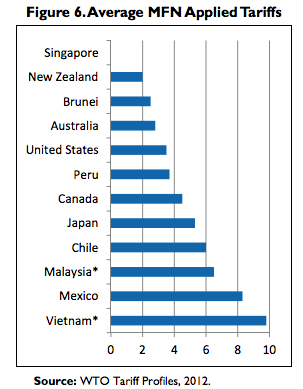

The TPP would help give the U.S. more favorable trade terms with Malaysia. Malaysia is also growing faster than almost any other potential TPP member, posting 5-7 percent growth in every year of the last decade except 2009. But Malaysia has among the highest of prospective TPP members, with average import tariffs of around 6.5 percent.

The TPP would slash that, helping the U.S.’s growing trade deficit with Malaysia, which hit $13.1 billion in 2012.

The problem for the U.S. is that Malaysia’s prime minister, Najib Razak, has been dragging his feet on the negotiations and threatening to water down the TPP terms. The treaty, he worries, could threaten state control of certain industries, as well as its labor programs favoring ethnic Malays. Facing mounting political pressure to take a stand against any less-than-beneficial TPP terms, or to back out of the negotiations altogether, Najib has been stalling. If skittish countries like Malaysia dilute the TPP—or if Najib ditches the talks—the U.S. loses clout in countering the RCEP’s influence.

That’s put Obama in a tough position, says Bridget Welsh, a political science professor at Singapore Management University. ”The fact is that Obama’s visit would have been an endorsement for Najib,” she says, “when domestically he has been sending all the wrong signals.”

However, Najib relies heavily on foreign policy legitimacy to bolster his support. And in that, the U.S. is no longer the biggest player; it also must contend with China.

“[Malaysia] is on the frontline in the U.S.-China contestation. This is why China is similarly wooing Malaysia extensively,” Welsh tells Quartz, noting that the country is exploiting the competition. “Malaysia wants the best of two worlds. They enjoy being ‘fought over’ and are taking advantage in multiple-track engagement.”

The U.S. and the TPP won’t necessarily come up in Xi’s special chats with Najib. But anything negative Xi has to say will fall to Kerry to counter. Thanks to Republicans in the House of Representatives in Washington, Obama won’t have that chance.