The role of country images and knowledge of their constitution and effects is of major interest not only for scholars and professionals in the domain of public diplomacy, but also for various adjacent fields such as...

KEEP READINGThe CPD Blog is intended to stimulate dialog among scholars and practitioners from around the world in the public diplomacy sphere. The opinions represented here are the authors' own and do not necessarily reflect CPD's views. For blogger guidelines, click here.

Performance of Congress-Financed Alhurra TV: Do Viewership Numbers and American Taxpayer Money Spent Add Up?

Testifying before the U.S. House Committee on Appropriations Subcommittee on State, Foreign Operations, and Related Programs, on March 9, 2023, the CEO of United States Agency for Global Media (USAGM), Amanda Bennett explained how competitive USAGM media outlets have remained in an international media environment that is increasingly challenged by international authoritarian media. In order to continue securing America’s competitive edge in this “global information war,” Bennett pleaded with the House Committee to appropriate more funds to her agency.

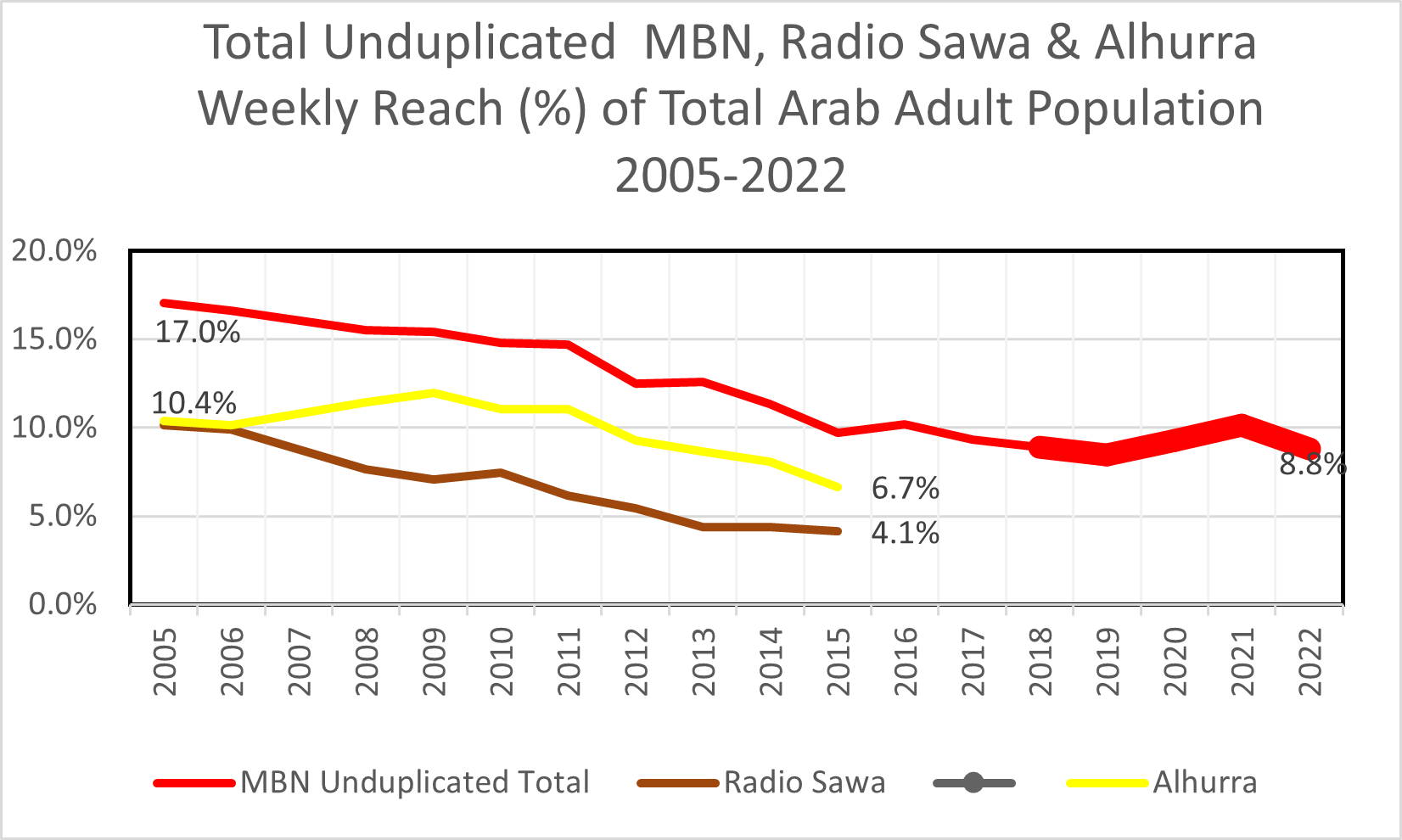

Bennett’s plea comes at a time where in the span of the last five years, USAGM media outlets have succeeded in increasing their combined global weekly reach by an impressive 47%, from a weekly audience of 278 million to 410 million between 2017 and 2022. (BBG/USAGM annual audience data for individual years between 2005 and 2022 used in this analysis are taken from the BBG/USAGM Annual Reports for each of the respective years.) This phenomenal audience increase was paralleled by a mere 4.5% increase in the organization’s total annual budget from $794 million to $830 million between 2017 and 2022.

As Congress debates how much additional money to appropriate to USAGM, it may be worthwhile examining how the USAGM, as a total group, with a marginal increment in its total annual budget, has managed to accomplish its recent outstanding performance. And by contrast, Congress should consider how Alhurra, even after a complete “transformation” between summer 2017 and fall 2018, has continued lagging behind its USAGM sisters.

An analysis of the comparative performance of Alhurra versus other USAGM media outlets as a group should invite a closer examination of the share of resources that are appropriated to individual outlets and their corresponding contribution to the success of the USAGM as a whole and their autonomous successes in achieving the goals assigned to each.

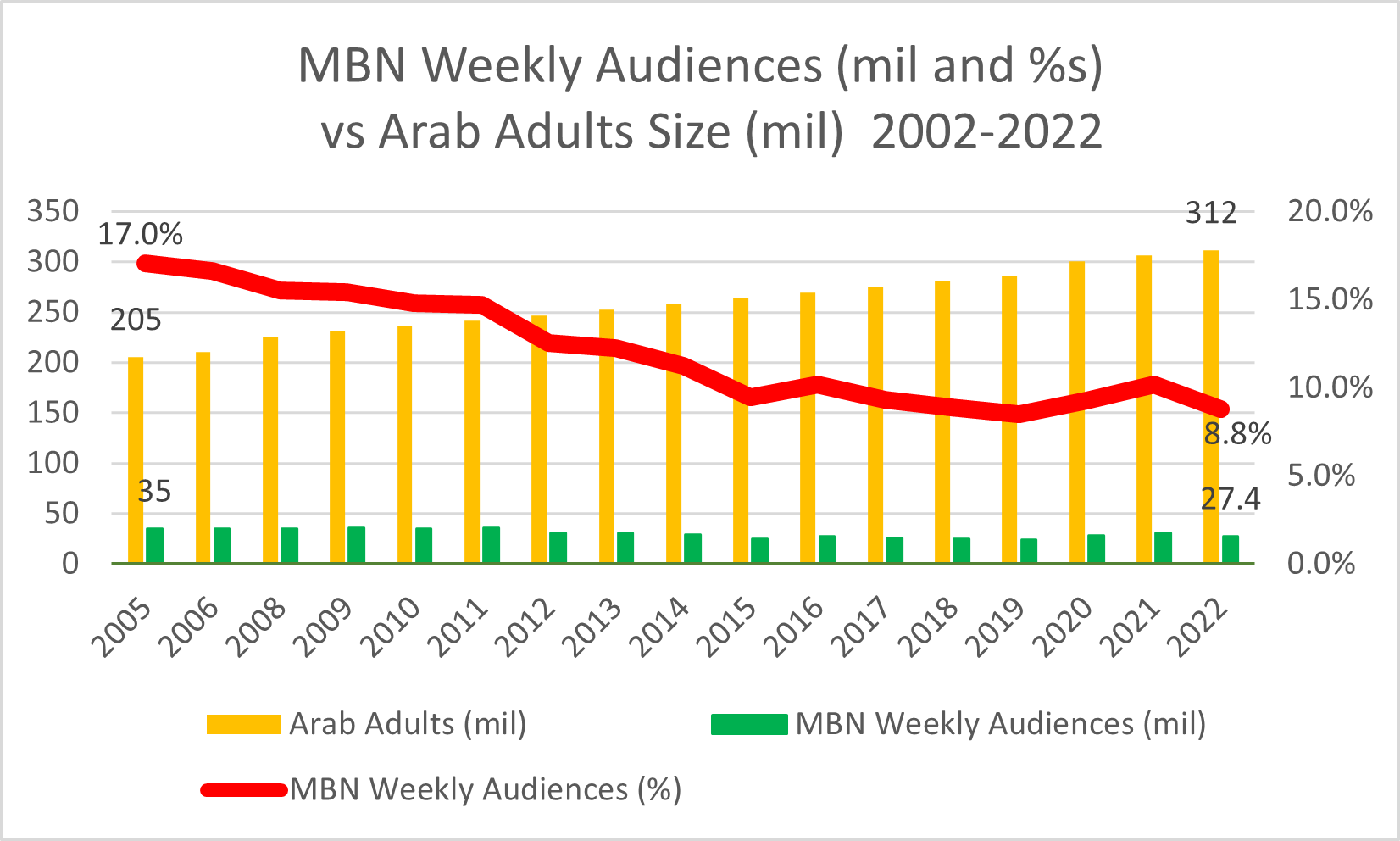

In 2005, one year into the launch of Alhurra and three years after the launch of FM Radio Sawa, MBN combined weekly reach swelled to 35 million, a weekly reach that remained unchanged for the next six years. From 2012 onwards, the weekly reach of Alhurra skidded to 30 million; and for the past ten years, it has maintained an average weekly reach between 25 to 27 million. After the new launch in 2018, the weekly reach barely went up beyond past performance.

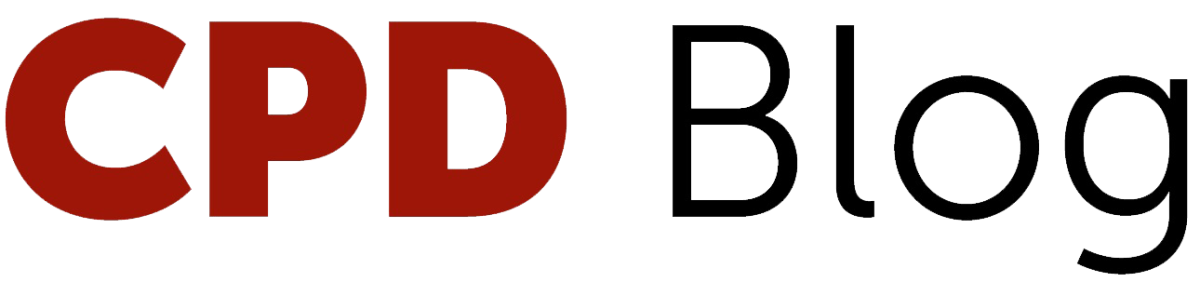

However, as shown in chart 1, once MBN absolute figures weekly audience data are converted into percentages of the total adult population, it becomes clear that the audience data reported by MBN conceals its actual performance. Viewed as such, the data reveal that, in relation to the growing total Arab adult population, MBN has been steadily suffering from a gradual decline in its weekly reach. (In this analysis MBN annual audience data is projected on the total Arab adult population (15 years+) for the respective years. Arab adult population data is calculated as a percentage of the total Arab population which ranged between 64% and 65% (of the total population) as per the World Bank Arab population data between 2005 and 2022.)

In the span of 19 years, the overall percentage of the adult Arab population making up MBN’s weekly audiences shrank by 48 percentage points, from 17% in 2005 to 8.8% in 2022. In reality, a population increase should be considered an opportunity since the targeted potential population is increasing, which MBN could not capitalize on.

Chart 1

Chart 2

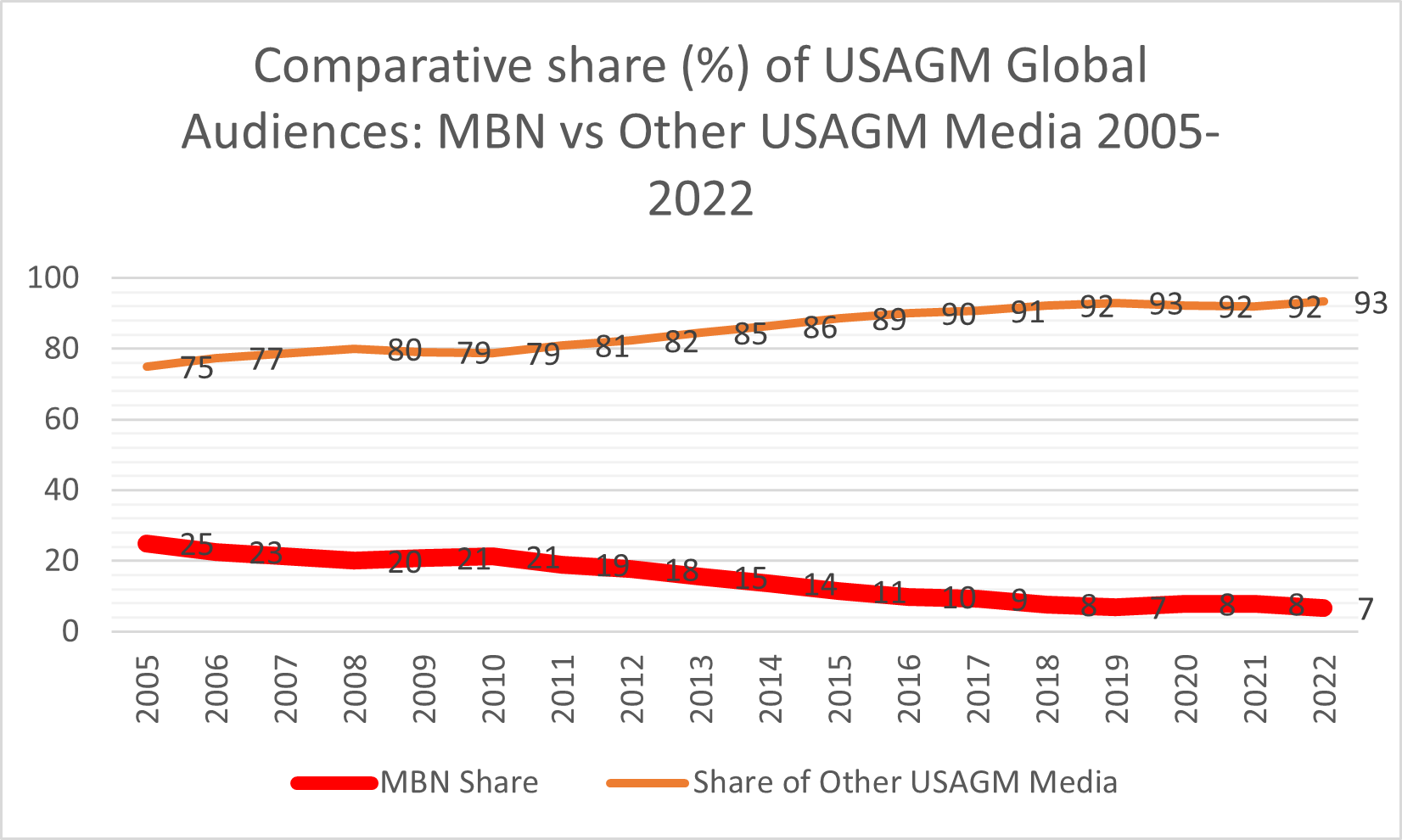

Throughout the period under study, MBN’s share of total USAGM audiences has been in a freefall mode from a share of 25% in 2005 to a mere 7% in 2022. This constitutes a decline in audience share of fully 72-percentage-points. This means that during its post-launch period of 2018 onwards, MBN failed to stop or even stabilize the decline of its total USAGM audience share. Indeed, it is evident that amid USAGM’s continued push to expand its overall global audience, Alhurra has been struggling to maintain its pre-2018 weekly audience size.

Chart 3

Chart 4

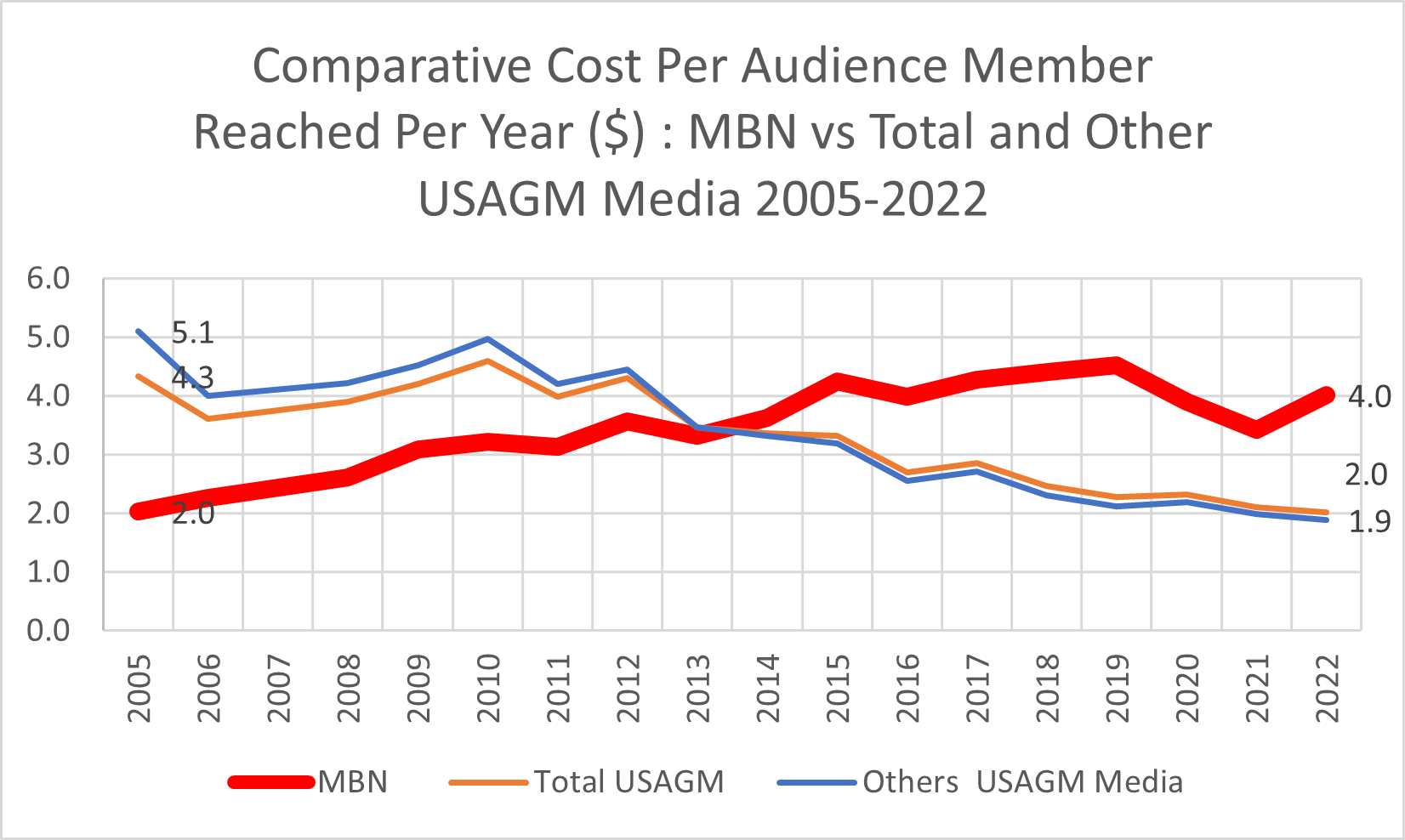

The efficiency of MBN takes another hit when we consider the cost of reaching a single audience member for an entire year. This is calculated by dividing the annual budget by the total number of weekly listeners and viewers. This translated into a cost of $2.00 per audience member reached for the entire year in 2005. By 2022, that same figure of cost per audience member doubled to $4.00. During these same 19 years, the overall cost per single audience member throughout USAGM experienced the exact reversed trend. The efficiency of MBN takes another hit when we consider the cost of reaching a single audience member for an entire year. This is calculated by dividing the annual budget by the total number of weekly listeners and viewers. This translated into a cost of $2.00 per audience member reached for the entire year in 2005. By 2022, that same figure of cost per audience member doubled to $4.00. During these same 19 years, the overall cost per single audience member throughout USAGM experienced the exact reversed trend.

Chart 5

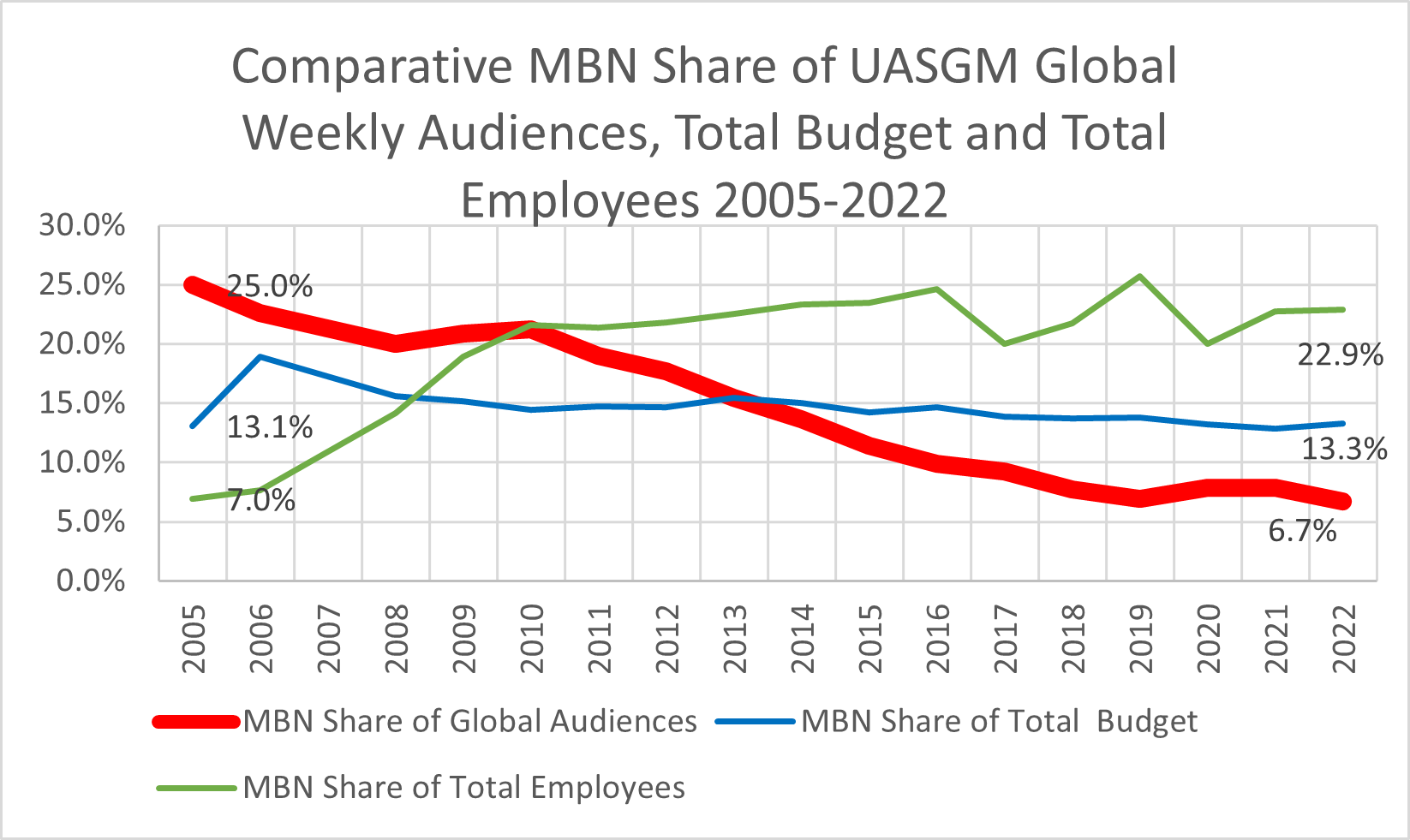

The relative cost inefficiency of MBN’s performance between 2005 and 2022 can also be detected when looking at its share of total audience, compared to its share of total USAGM employees. Historical data shows that the share of the MBN budget has throughout the period under study been maintained around 13-14% of the total USAGM budget. Yet the number of its employees, as compared to the total number of USAGM employees, presents a case study that is worth noting.

Starting with a staff of 220 in 2005, MBN’s share of the USAGM total was a mere 7%. MBN’s staff share started increasing in the course of the subsequent five years; and maintained an average of 22% to 24% throughout the rest of the period under study. What is perhaps most unique about MBN’s earlier performance efficiency in its infancy was that with a 7% share of total BBG employees, it generated 25% of BBG total audience. More startling is the fact that in 2005, with a $71 million budget, 220 employees succeeded in reaching a weekly audience of 35 million; whereas in 2022, with a budget of $110 million, MBN’s 850 employees barely managed to attract any new audiences beyond the number attracted before the 2018 relaunch.

Chart 6

As the US Congress debates the amount of additional funds to be appropriated to USAGM, as requested by its CEO, Amanda Bennett, their decision should be informed by an introspective look into the historical performance of individual outlets versus total USAGM performance. And any additional investments ought to be decided upon based on the returns to the marginal increases in the budget. Returns are to be assessed in terms of the extent to which a media outlet is expanding its weekly reach. Obviously, returns in terms of impact data already collected by USAGM ought to be incorporated into a more elaborate performance model.

Comparative trends show that Alhurra has in the past decade become the black sheep in the USAGM herd. This ought to raise several research questions that USAGM annual reports are not raising. One such is why, despite a complete and expensive overhauling of Alhurra, has its post-2018 performance turned out to be less impressive than its previous one? Why hasn’t the money invested in Alhurra added up to greater weekly audiences?

Visit CPD's Online Library

Explore CPD's vast online database featuring the latest books, articles, speeches and information on international organizations dedicated to public diplomacy.

POPULAR ARTICLES

-

January 29

-

January 20

-

January 28

-

February 6

-

January 28

Join the Conversation

Interested in contributing to the CPD Blog? We welcome your posts. Read our guidelines and find out how you can submit blogs and photo essays >.